80% of the mutual funds are not able to outperform nifty 50

Posted on May 29, 2023 by Quantplay Team ‐ 3 min read

Is your mutual fund investment really profitable? We have found some really intresting data and Today we are going to compare mutual funds and index funds.

Before we dive into how index funds have been out performing the mutual funds, Let us first try to understand the differences between mutual funds and index funds.

1) Mutual funds –

Mutual funds are actively managed by fund managers. These fund managers do deep research and cherry pick the stock according to the theme of their funds. The aim of most of these funds is to beat the return of their benchmark index.

Due to this, The charges we as investors incur are much more in actively managed mutual funds as compared to index funds.

The charges levied are of 2 types –

A) Expense ratio – Expense ratio is basically a management and operating fees of a mutual fund.

B) Exit load – This charge is levied when investors exit through the mutual fund scheme. The average exit load of mutual funds is around 1%.

2) Index funds –

Index funds mirror benchmarks like nifty 50. These funds are also called as passive funds because they don’t need to be actively managed. So, The returns these funds give is almost similar to the returns of their benchmarks.

As this funds are passively managed, The charges we as investors incur are much less as compared to actively managed mutual funds.

Now let us look at some intresting information about these funds-

According to an article by nerdwallet ,“More than 90% of mutual funds that were actively managed underperformed compared to the s&p 500 index from the year 2001-2016”. And according to moneycontrol, “More than 80% of mutual funds can’t beat the returns of index funds”.

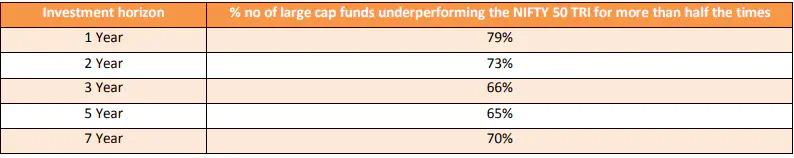

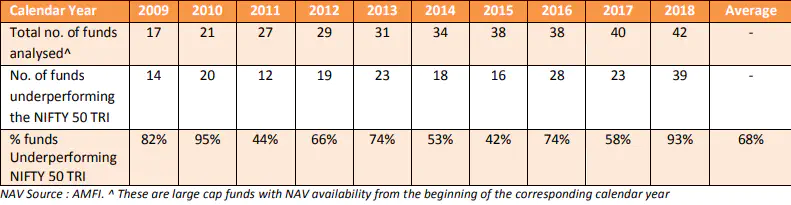

Seeing all of this does really make you wonder that‘ Is paying those hefty expense ratio really worth the deal?’ Even the NSE’s whitepaper has a say on this and I quote, “Active mutual funds that previously managed to generate reasonable alphas by outperforming the benchmark, now find it difficult to beat the benchmark. Outperforming the NIFTY 50 benchmark index by large cap funds has increasingly become more difficult. It is observed that ~68% of the funds have not been able to beat the benchmark over the last 10 years.”

If you are not convinced still, Looking at these images will certainly help –

Conclusion –

Index funds seems to be the most lucrative investing product if your goal is long term investing. Whether it is charges or returns, Index funds have outperformed mutual funds in every respect.

By the way, This is one of the reasons why we have always preferred algorithmic trading. If you want to grow your money systematically, Trading based on algorithms will give you consistent returns over a long period of time. As the strategies used are back-tested thoroughly. These mutual funds have been over charging and underperforming since years now. It is time that we change our approach towards this.